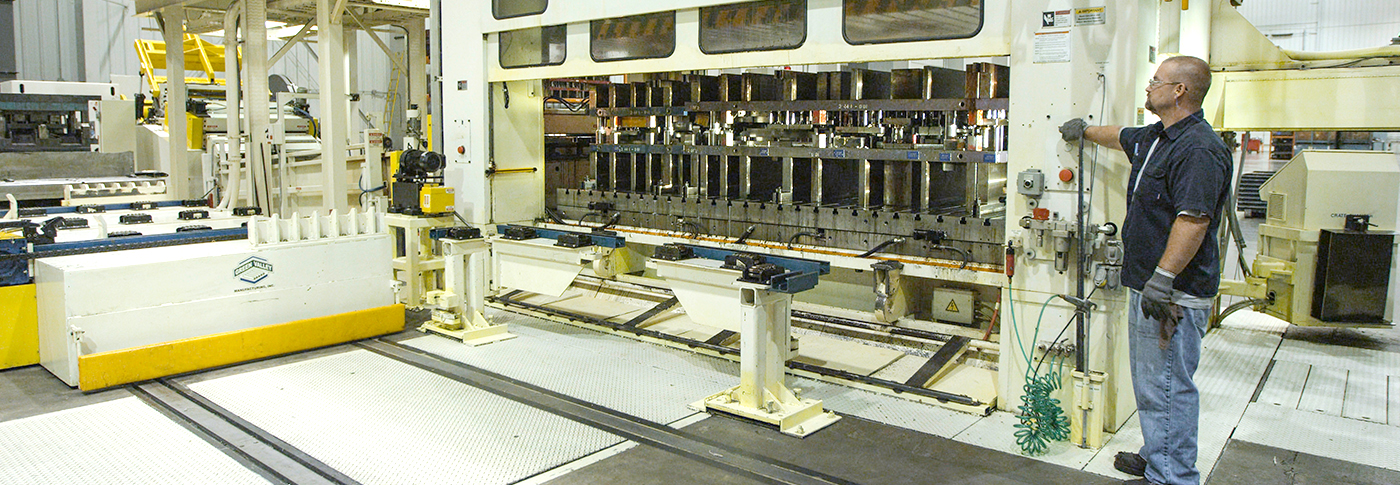

Business-Friendly with Powerful Incentives

The secret is out about Indiana and its business-friendly environment. With one of the highest bond rating in the nation, Indiana has its fiscal house in order. Known for its lowest workers compensation rates and multiple top rankings for being one of the top states for businesses, Indiana makes it affordable for businesses to operate across the state… and, it’s getting better every year.

Each year, Indiana is lowering its corporate income tax rate until it reaches 4.9% by 2021, which will make it one of the lowest in the nation. Indiana has no gross receipts tax or inventory tax making it even more advantageous for businesses to locate and grow here.

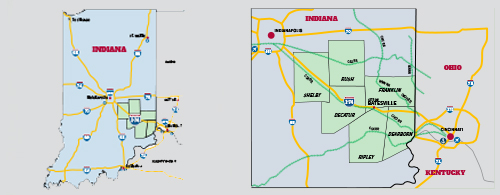

The I-74 Corridor’s economic development partners have followed Indiana’s lead to make this region one of the most attractive in the state by establishing several Tax Increment Finance (TIF) districts. Our TIF districts benefit businesses by capturing property taxes for reinvestment in public infrastructure to support them and the communities they call home.

Employers throughout the I-74 Corridor may qualify for tax abatements and other local programs, too. The State of Indiana offers additional incentive programs to make it affordable and easy for companies to quickly get up and operating which include including payroll tax credits, training grants, and industrial development grants. Our utility providers also offer a number of incentives for our local businesses.

Our local governments work closely with employers to provide generous incentive programs aimed at lowering the cost of doing business. This helps new employers efficiently establish operations and existing employers expand their facilities.